The original text appears to be in Russian. Here's a professional translation to English, preserving the HTML markup:

```html

Vedomosti: Secondary luxury housing is not being sold

```

Note: The provided translation assumes that "Ведомости" refers to the Russian newspaper "Vedomosti".

Vedomosti: Secondary luxury housing is not being sold

At a round table in "Vedomosti. Real Estate" in September, market players agreed that the infamous location is no longer the most important thing for consumers. "The significance of the location is decreasing, and the role of project quality is increasing," says Andrey Khitrov, head of the strategic consulting and research department at Welhome. According to analysts from Est-a-tet, Point estate, and other companies, new expensive projects can be found in Presnensky, Tagansky, Alexeevsky, and Donskoy districts, as well as in Pokrovskoye-Streshnevo and others. Fortunately, the city itself is changing, new attraction points are emerging (parks, business areas), says Ekaterina Rumyantseva, Chair of the Board of Directors at Kalinka Group.

Old for New

"For the past four months, my clients' requests have been like: 'Let's sell the old one and move into something of higher quality'; 'While the price is good and everything is in rubles, let's look at something newer,'" shares Irina Zharova-Ryt, managing partner at Sesegar RE. "The old one" refers to houses from the 1990s to the early 2000s at addresses that were considered premium at the time, she clarifies. Now it's "neither shabby yet, nor has it become vintage, such a "second-best" option, which is quite difficult to sell, except to neighbors," says the realtor.

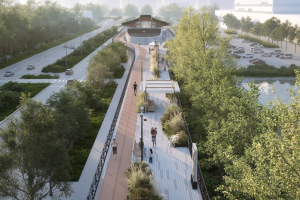

"If you compare houses on Ostozhenka, one of which was built in 2006, and the other was commissioned in 2013-2014, there is a significant difference in terms of finishing, facade solutions," says Ekaterina Teyn, Director of Retail Sales at PSN Group (which builds the elite complex "Polyanka, 44"). Merely being located in the center is no longer enough to sell everything before the building is put into operation and not worry about the quality, as it was in the 2000s, she notes. Until 2008, there were no developer-owned apartments available in already finished buildings - in the last two years, there have been more and more. Therefore, it is important for the beautiful picture to match reality. "The developer now spends much more on creating the product, on architecture, landscape design. While it may not be a significant expense in overall construction costs, it has definitely started to receive more attention," says Teyn. Ilya Mashkov, head of the architectural workshop "Maison Projet," notes that architects are increasingly involved in interior design and all the little details in finishing and facades that customers, who are not inclined to spontaneous purchases, now look at closely.

Therefore, "new developments rule," says Irina Mogilatova, CEO of Tweed. "There are quite a few projects on the market in good locations with functional layouts, infrastructure, and landscape design at reasonable prices." Such complexes are not located on the "golden mile," brokers refer to them as "premium" or "business plus" segments, although their cost does not differ significantly from the cost of building luxury housing, says Elena Komissarova, CEO of BEL Development (which builds, among other things, an elite residential complex in the Basmanny district).

Centrifugal Forces

If you don't cut corners on quality, you have to compromise on margin, developers note. However, such properties are selling "at a good pace." Including to buyers from the outskirts of Moscow or residents of the same district. For example, FSK "Lider" is counting on the patriots of the district by offering a premium 400-apartment building in the Timiryazevsky district of Moscow. Dmitry Khalin, managing partner at IntermarkSavills, predicts further quality supply in "not the most top-rated districts" and "it will find its consumer." The trend is not new, but now the process of elite decentralization is gaining strength.-The expansion of the product range is considered a logical decision by Ekaterina Batynkova, the commercial director of Insigma Group. Insigma is currently implementing the premium-class residential complex RedSide in Presnensky District and developing two elite projects. "New properties will appear simply because converting land into apartments is always profitable, even at a different cost," believes Ekaterina Rumyantseva, the Chairman of the Board of Directors of Kalinka Group. Her opinion is supported by Alexey Boldin, the CEO of Magistrat Agency (part of Inteko Group): the real estate development business has been highly profitable, "so there is a margin of safety." According to him, Inteko does not refuse to acquire new projects. According to calculations by Aecom specialists, the cost of construction of elite real estate or business class in Moscow can range from 70,000 to 90,000 rubles per square meter, excluding VAT. It is increasing due to expenses for imported construction materials and engineering equipment. The cost of land and the price of money should also be taken into account, "and builders are not getting cheaper," adds Komissarova. Mogilatova even believes that developers will raise prices: "They can't work at a loss." But these will already be ruble prices. "You can recalculate everything however you want in business plans, but we are still selling square meters in a specific metropolis, not oil," concludes Komissarova. According to Knight Frank, 70-80% of elite apartments and apartments on offer are currently nominated in rubles. Methods of selling Developers have learned to present projects, and the houses look luxurious on websites, praises Mashkov. Nevertheless, it is currently extremely difficult to sell "while the construction site is still in progress," realtors complain that they "can't even attract customers with price." The secondary market puts pressure on sellers of new buildings, according to Alexey Treschev, Director of Urban and Rural Real Estate at Knight Frank, where the discount reaches 30-50%. Developers cannot afford to give such discounts. Khalin believes that long installments from developers, tied to the construction schedule, are necessary. At Magistrat, they have already started developing tools that "allow people who don't have enough money to have luxury housing," said Boldin, adding leasing to installments, which, in his opinion, is even more convenient than a mortgage for elite buyers.

Read also

Stay up to date with the latest news

We promise to send only interesting and important articles.