The devaluation of real estate in Russia

The economic instability and fluctuations of the ruble have had a direct impact on the Russian construction market. In recent months, there have been bankruptcies of large companies and a reshuffling of the market. What are the other changes faced by Russian and foreign actors in the construction and real estate market over the past two years, and how are they adapting to the new realities? Analysis by L'économika.

Over the past two years, the Russian construction market has experienced significant changes. Su-155, Mostovik, Zhilishchnyy Kapital, Morton - this is just a partial list of large real estate companies that have gone bankrupt or left the market since 2014.

"The downfall of many real estate developers and project companies, often highly experienced and professional, is due to lack of financing and therefore a reduction in the number of new projects," explains Anastasia Sementchenko, Deputy General Director of the MKZ projects office. According to her, many recently bankrupt companies have been placed in difficult conditions, "with extremely high interest rates and insufficient funding from clients, including public orders."

One of the most high-profile bankruptcies in recent years was the Omsk-based company Mostovik, known for its large infrastructure projects across the country, including the Russky Island bridge in Vladivostok and the Sochi Olympic sites. These projects proved to be unprofitable, and Mostovik stopped repaying its loans and was declared bankrupt in June 2015. The owner of the company, Oleg Chichov, was found guilty of tax fraud and sentenced to four years in a penal colony.

The devaluation of the ruble has particularly affected smaller market players. Many of them had to restructure their foreign currency loans with banks, and those who worked in the premium segment and imported construction materials had to reduce their margin to stay on the market. "In one year, prices have significantly increased, by 70% for example for laminated metals, pipes and fittings," comments Ms. Sementchenko.

"The year 2015 was the most difficult for developers as they tried to restructure their loans: rents were in dollars and euros, just like the loans they received from banks. When, against the backdrop of crisis, owners were forced to lower rents in dollars, cash flows from real estate dropped and developers had to negotiate with banks," explains Nikolaï Kazanski, Managing Associate at Colliers International.

"The fact that banks responded to the wishes of companies and decided not to seize real estate as they did during the 2008 crisis shows that the Russian market has developed and become more mature," comments Nikolaï Kazanski.

Overall, experts recognize that the current crisis has led to an expansion of market players: large companies are absorbing medium and large enterprises. For example, A101 was acquired by the Safmar group (formerly B&N) at the end of 2015; FSK Leader announced the acquisition of Domostroïtelny kombinat n°1 (DSK-1); and the PIK group took over the Morton company. The journal Vedomosti reported last summer that billionaire Mikhail Prokhorov was preparing to sell the OPIN real estate group, another heavyweight in the Russian market.

Furthermore, experts no longer observe in 2016 the sense of despair that had seized market players the previous year amid ruble volatility and escalating tensions between Russia and the West. They attribute this, on the one hand, to the stabilization of the Russian currency and, on the other hand, to the fact that companies have gradually adapted to the new reality of the crisis and have begun to play by new rules.

If Russo-Turkish relations are gradually stabilizing, establishing contact with the West is not imminent. Moreover, according to market participants, it is not so much the sanctions that hinder the activity of foreign investors in Russia, but rather the climate of distrust that characterizes the Russian market today.

"The problem lies more in the general atmosphere of mistrust and the uncertainty regarding future economic models and their reliability. Even if Russia is able to withstand Western sanctions, the number one question remains the transparency of the policy," explains Jean Pistre.

Some more optimistic experts, however, believe that the worst is behind us. "While 2014 and 2015 were marked by a decline in foreign investment, 2016 has seen an influx of foreign investors who have partially adapted to the situation during this period. This includes companies that have localized their production in Russia," comments Anastasia Sementchenko.

Light at the end of the tunnel?

Experts acknowledge that if we consider sectors on a case-by-case basis, it is the residential construction sector that is weathering the current crisis the best. According to data from the Russian Federal State Statistics Service (Rosstat), housing construction increased by 6.5% in August 2016 compared to the same month in 2015, and the majority of new housing is being built in major cities, particularly in Moscow and St. Petersburg.

"There is a constant influx of new arrivals in major cities, where the relatively high level of wages (compared to those in the regions) allows residents to buy an apartment," notes Ms. Sementchenko.

The development of the residential real estate market has been partly aided by the devaluation of the ruble. "The weakening of the Russian currency has favored deals with foreign clients, as once converted into dollars and euros, real estate offers in Moscow have become almost twice as accessible to Europeans. The Russian real estate market has also become more attractive to citizens from neighboring countries who have savings in dollars," says Ekaterina Rumyantseva, Chairman of the Board at Kalinka Group.

In addition, there is an increase in the number of commercial spaces in major cities. According to JLL, in the third quarter of 2016, 190,200 square meters of high-quality commercial space were built in Moscow, four times more than in the same period in 2015.

"This year, we have seen an improvement in the situation in the commercial real estate market. We attribute this, firstly, to the demand compressed by the crisis and, secondly, to the fact that households still need consumer goods and food. In the regions, this trend is, of course, weaker than in Moscow, but store chains like Auchan and Leroy Merlin and their Russian equivalents continue to develop throughout Russia," observes Anastasia Sementchenko.

However, the construction of commercial premises put into operation in 2016 had already begun before the crisis. JLL predicts a 40% decrease in the number of new high-quality shopping centers in Moscow in 2017 compared to 2016. According to the real estate consultant's data, in the third quarter of 2016, the vacancy rate in Moscow shopping centers reached 8.5%.

"The least rational and least well-founded investments today are those made in shopping and business centers, given that the difficult economic environment has led to a significant increase in vacancy rates, a decrease in rents, and, consequently, a longer return on investment," observes Ekaterina Rumyantseva.

According to Colliers International, in the first half of 2016, Moscow had nearly 15% of office space vacant. However, experts predict a soon decrease in this percentage.

"Considering the speed of occupancy of office space recorded in Moscow recently, the vacancy rate should be zero within the next three years," estimates Nikolai Kazansky.

According to him, Moscow should once again experience a shortage of office space, as construction needs to start today so that they can be put into operation in four years. "Office space needs to be occupied quickly because there won't be enough for everyone," he advises.

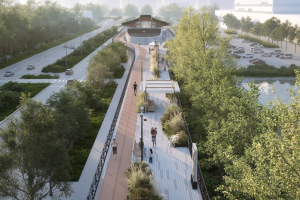

Experts also see favorable conditions for an increase in investments in commercial real estate in the policies of the Moscow authorities, who are developing a series of infrastructure projects in the capital. This includes, for example, the circular railway line MTsK, inaugurated in September 2016, as well as the construction of new subway stations.

"Today, Moscow is the city with the fastest infrastructure development pace in the world. This is what developers have been waiting for a long time. For example, the creation of the new interchange hub that is MTsK allows for an increase in the value of neighboring plots, which is very advantageous for developers," concludes Nikolai Kazansky.

Read also

Stay up to date with the latest news

We promise to send only interesting and important articles.