New business class buildings in Moscow

According to the results of the 4th quarter of 2024, the number of lots for sale in the Moscow business-class residential real estate market increased compared to last year.

The volume of supply amounted to 1,383 thousand square meters, unchanged during the quarter and increased by 7% over the year. At the end of the 4th quarter of 2024, 158 projects in the business class segment were on sale (there were 146 projects a year earlier).

The number of lots on offer in the segment was 21,762 units, which is almost equivalent to the figure for the 3rd quarter of 2024 and 10% more than in the 4th quarter of 2023.

Chart. Dynamics of the number of lots for sale in the primary business class housing market, 3-4 Qq 2021-2024

In the 4th quarter of 2024, sales started in 6 business class projects: Krylatskaya 33, My Priority Mnevniki, Rakurs, Mira, Marilnn Park, High-rise on Zhukova. The total number of declared lots in new projects is 3,792 units per 228,355 thousand square meters. m. The share of lots that went on sale for new projects is 16%.

In addition, new buildings in the following projects went on sale in the 4th quarter of 2024: Primavera (Bellini building), Moments (building 2.2), Portland (buildings 6 and 8), Rodina Park (Building 4), Sezar City (building 1.4), Cityzen (buildings 2, 3, 4 and 5), Wednesday at Lobachevsky (buildings 5.5, 5.6, 5.7 and 5.8), Very (building 4). A total of 1,233 lots for 75.1 thousand square meters are on sale.

Table. Summary supply figures for the primary business class housing market

Table. New projects in the primary business class housing market in Moscow, which started with sales in the 4th quarter of 2024

According to the results of the 4th quarter of 2024, the largest share of supply in new business-class buildings in Moscow is at the stage of floor installation (44%). 25% of the supply is at the excavation stage, 16% of the supply is the share of the supply of lots in projects that are put into operation, 15% of the supply are lots in projects at the hull finishing stage. In the 4th quarter of 2024, the following supply structure was formed:

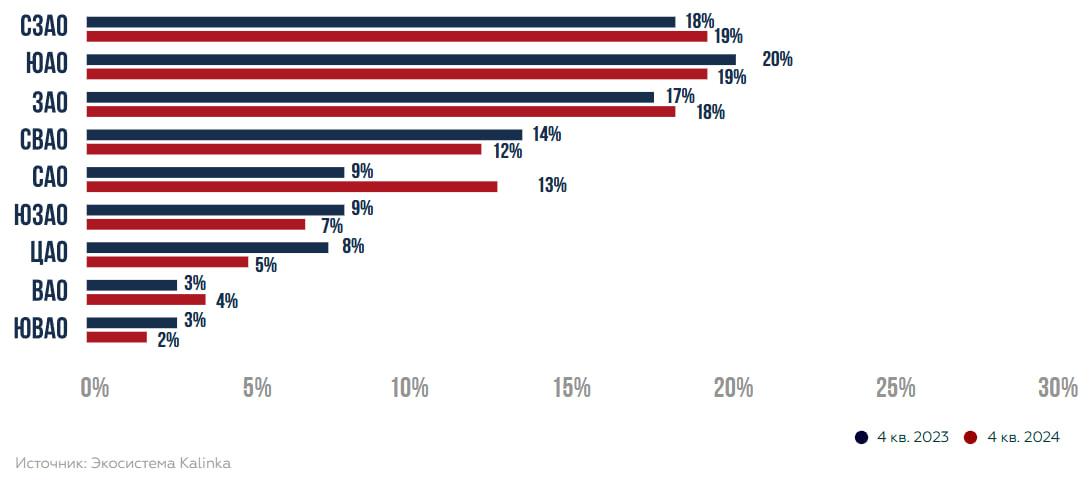

In terms of the number of lots on sale, the North Caucasus Federal District is in the first place with a 20% share. Next in the ranking are the Southern Administrative District (19%) and CJSC (17%).

CHART. Distribution of the volume of supply of business class apartments/apartments on display by districts based on the results of the 4th quarter of 2024, sq. m in %

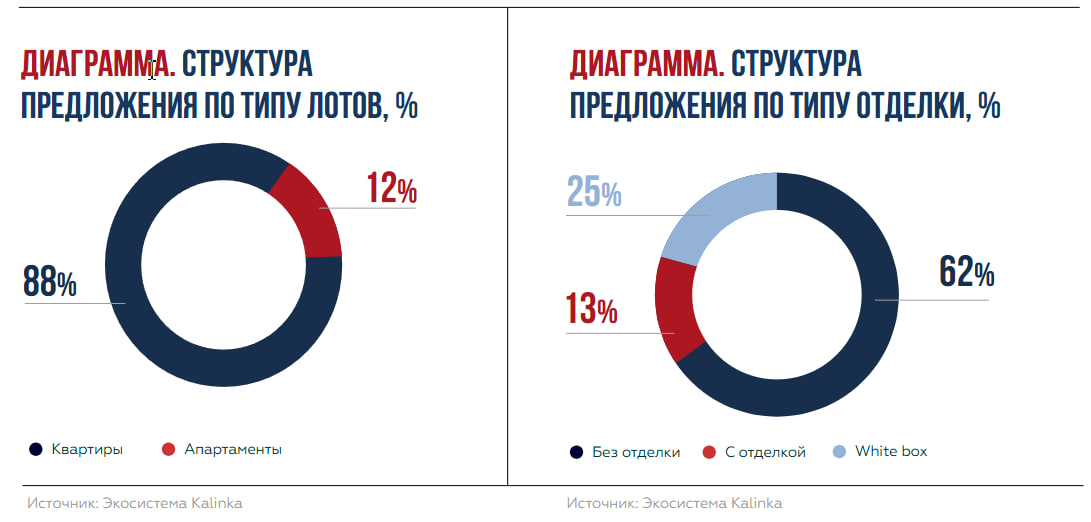

By type of premises, traditionally the largest part of the supply in the 4th quarter of 2024 is represented by apartments, the share of which was 88% (+1 percentage point by the 3rd quarter of 2024). Compared to the 4th quarter of 2023, the share of apartments in the supply increased by 3 percentage points. The share of apartments in the supply in the 4th quarter of 2024 was 12%, respectively, which is 2 percentage points less than last year. According to the results of the 4th quarter of 2024, the distribution of lots in the supply is dominated by lots without finishing (62%), which is equivalent to the same indicator in the 3rd quarter of 2024. One quarter of the offer is occupied by lots with pre-finishing (White Box): 25%, which is 1 percentage point less than in the 3rd quarter of 2024 and 2 percentage points more than in the 4th quarter of 2023. The finished lots in the offer account for only 13% of the total (-1 percentage points compared to the 3rd quarter of 2024 and -2 percentage points compared to the 4th quarter of 2023).

According to the results of the 4th quarter of 2024, the distribution of supply across the range of lot areas has not changed significantly compared to the 3rd quarter of 2024. The first place in terms of the share of supply in the Moscow business class segment is occupied by a range of lots with an area of 40-55 square meters. m with an indicator of 24.5%, as in the 3rd quarter of 2024; +2.5 percentage points by the 4th quarter of 2023. In second place is the range of lots with areas of 55-70 square meters, the share of which was 22%, having decreased by 1 percentage point compared to the 3rd quarter of 2024 and by 2 percentage points compared to the 4th quarter of 2023. In third place is the range of lots with areas of 25-40 square meters, the share of which remained unchanged for the quarter and amounted to 16%. By the 4th quarter of 2023, the dynamics was +1.5 percentage points. According to the results of the 4th quarter of 2024, the average lot area for sale did not change significantly. The figure was 63.6 square meters, which is equivalent to the figure for the 3rd quarter of 2024 (63.4 square meters). Compared to the 4th quarter of 2023, the indicator decreased by 2%.

CHART. The structure of the offer of business class apartments/apartments by area, %

Price situation

According to the results of the 4th quarter of 2024, the weighted average offer price in the Moscow business class market reached a record high of 563.3 thousand rubles / sq. m. The dynamics of the indicator compared to the previous quarter was +4% and +17% by the 4th quarter of 2023. The current balance of supply, the massive launch of sales of projects in 2024, as well as high demand due to the fact that developers offer installment programs, including interest-free, for a period of 1-3 years, have the greatest impact on the price situation in the Moscow business class segment.

TABLE. Summary price indicators of supply in the primary business class housing market in Moscow

CHART. Dynamics of the weighted average price of the business class offer, RUB per sq. m, 2022-2024

According to the results of the 4th quarter of 2024, the Central Administrative District remained the most expensive district in Moscow in the business class segment. The weighted average price in the Central Administrative District increased by 15% over the year and reached 613.7 thousand rubles / sq. m. Compared to the previous quarter, the indicator increased by 6%. In second place, as in the 3rd quarter of 2024, is the Western Administrative District. The weighted average price in the district reached 601.4 thousand rubles / sq. m. The dynamics of the indicator compared to the previous quarter was +2%, and by the 4th quarter of 2023 +21%. The Northern Administrative District is in third place in the rating, with its price reaching 595.2 thousand rubles / sq. m, which is 2% higher than in the 3rd quarter of 2024 and 15% higher than in the 4th quarter of 2023.

Table. Weighted average offer price of business class, RUB per sq. m. by district (annual dynamics, %), based on the results of the 4th quarter of 2024

Demand

In 2024, the number of business class transactions decreased by 8% compared to 2023. The main reason was the gradual increase in the key rate from the beginning of 2024: from 16% to 21%, as well as the cancellation of the mass preferential mortgage program, which was in effect until July 1, 2024. In the second half of 2024, 13,406 transactions were concluded, which is 31% less than in the same period of 2023. The volume of demand in square meters for the 2nd half of the year amounted to 805.5 thousand square meters, a decrease of 29% compared to 2023.

Table. Summary of transactions in the primary business class housing market

In the 4th quarter of 2024, there was a traditional activity on the part of customers compared to the 3rd quarter of 2024: developers offered discounts on a certain pool of lots on the eve of the New Year holidays, in addition, developers actively use such a sales tool as interest-free installments for a period of 1-3 years. In the 4th quarter of 2024, 7,372 transactions were completed, which is 22% higher than in the 3rd quarter of 2024. Relative to the 4th quarter of 2023, demand decreased by 25%. The volume of demand in the 4th quarter of 2024 amounted to 445.9 thousand square meters, an increase of 24% over the quarter. Relative to the 4th quarter of 2023, this indicator decreased by 21%. Such demand dynamics in 2024 were expected after a phased increase in the key rate and the collapse of the "mortgage market": installments with various options have replaced them, to which both developers and buyers have successfully adapted, as statistics on transactions in the business class segment of residential real estate in Moscow show. Taking into account the discounts provided by developers, the weighted average price of the requested lot in the 4th quarter of 2024 was 534 thousand rubles / sq.m. m, which is 3% higher than in the 3rd quarter of 2024 and 11% higher than in the 4th quarter of 2023.

Table. Summary of transactions in the primary business class housing market. 4th quarter 2023 – 4th quarter 2024

CHART. Dynamics of the number of transactions (units) in the business class market and the weighted average unit purchase price (thousand rubles per square meter), 2021-2024

As expected, the number of mortgage transactions decreased (according to the DDA). Against the background of the increase in the Central Bank's key rate, the share of mortgage transactions in demand in the 4th quarter of 2024 decreased to 28% (for comparison: 60% of mortgage transactions were in the 4th quarter of 2023 and 44% of mortgage transactions were in the 3rd quarter of 2024). In absolute terms, the dynamics of mortgage demand by the 3rd quarter of 2024 was -20%, and by the 4th quarter of 2024 - 65%.

The average area of the lot in demand in the 4th quarter of 2024 increased by 1% compared to the 3rd quarter of 2024 and amounted to 60.5 sq. m. Over the year, the indicator increased by 2%.

The distribution of demand across the area range in the 4th quarter of 2024 has not changed: customers prefer lots up to 70 sq. m. Lots in the range of 40-55 sq. m remain the most in demand. m with a share of 26% in demand (unchanged by the 3rd quarter of 2024 and -2 percentage points by the 4th quarter of 2023). In second place are lots with an area of 55-70 square meters. m with a share of 23% (+3 percentage points by the 3rd quarter of 2024 and +1 percentage point by the 4th quarter of 2023). Next are lots with areas of 25-40 sq. m. m with a share of 18% in demand (-2 percentage points by the 3rd quarter of 2024 and -1 percentage point by the 4th quarter of 2023).

The average area of a sought-after apartment in the 4th quarter of 2024 was 61.4 sq. m.

The distribution of purchased lots by area has not changed much over the year. Thus, lots in the range of 40-55 square meters were in the highest demand among apartments in the Moscow business class market. m with a share of 26% (unchanged from the 3rd quarter of 2024 and -3 percentage points compared to the 4th quarter of 2023). In second place are lots with an area of 55-70 square meters. m with a share of 23% (+2 percentage points by the 3rd quarter of 2024 and +1 percentage point by the 4th quarter of 2023). In third place are lots with areas of 25-40 sq. m. m with a share of 17% (-2 percentage points by the 3rd quarter of 2024 and -1 percentage point by the 4th quarter of 2023).

The average area of the sought-after apartments was 40.2 sq. m.

Apartments in the area range of 25-40 square meters were in the highest demand in the 4th quarter of 2024. m with a share of 39% (+3 percentage points by the 3rd quarter of 2024 and +2 percentage points by the 4th quarter of 2023). The second place is occupied by lots with an area of 40-55 square meters. m with a share of 26% (-3 percentage points by the 3rd quarter of 2024 and +5 percentage points by the 4th quarter of 2023). In third place are lots with an area of 55 70 sq. m. m with a share of 16% (+1 percentage points by the 3rd quarter of 2024 and -5 percentage points by the 4th quarter of 2023).

CHART. Distribution of demand for business class apartments by area, %

FLATS

APARTMENTS

In the 4th quarter of 2024, the territorial demand situation in the Moscow business class market is as follows: the North-Western Administrative District took the first place in terms of the number of lots sold with a 20% share (+1 percentage point by the 3rd quarter of 2024 and +1 percentage point by the 4th quarter of 2023 year) due to sales in the Ostrov projects from the developer Donstroy (17% of the demand in the location), the new Rakurs project from the developer Dar Development (15% of the demand in the location), Level Zvenigorodskaya, Sydney City (in each project, the share of the lots sold was 10%) and "City Bay" (9% of the demand in the location).

The leader of the previous quarter in terms of the number of lots sold, the Southern Administrative District, moved to second place with a share of 18% (-4 percentage points by the 3rd quarter of 2024 and -3 percentage points by the 4th quarter of 2023) due to sales in projects such as Zilart from LSR Group (25% of the demand in the location), "Paveletkayacity" from MR Group (15% of the demand in the location), "Shagal" from Etalon Group (14% of the demand in the location) and "High Life" from Pioneer Group (11% of the demand in the location). CJSC closes the top three districts in demand for the 4th quarter of 2024 with a share of 16% (-1 percentage points by the 3rd quarter of 2024 and -2 percentage points by the 4th quarter of 2023) due to sales in projects such as Level Michurinsky (20% of demand in the location), Event from Donstroy (17% of demand in the location), Will Towers (13% of demand in the location) and Wednesday on Lobachevsky" (13%).

The highest average transaction budgets in demand were observed in CJSC, Central Administrative District and Southern Administrative District: 37.5 million rubles (+5% by the 4th quarter of 2023); 35.7 million rubles (+10% by the 4th quarter of 2023) and 32.2 million rubles (+6% by the 4th quarter of 2023 year), respectively. The lowest transaction budgets were observed in the Southern Administrative District (27.5 million rubles; +19% compared to last year) and the VAO (29.2 million rubles; -2% compared to last year).

Rating: TOP 5 leading projects in terms of the number of transactions in 2024: Chagall (5%), Ostrov (4%), Zilart (4%), Event (4%), Level Michurinsky (3%).

CHART. The structure of demand for business class apartments by district based on the results of the 4th quarter of 2024, in %

Table. Distribution of supply in the market of new business class buildings by area and cost, 4th quarter of 2024, %

Table. Distribution of demand for 2024 in the market of new business class buildings by area and purchase budget, %

Similar articles

Broker help

We will help you find, buy or sell real estate