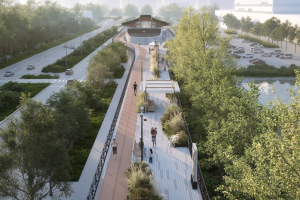

Closer to Staryy Plushchad.

Prices for new buildings in the center of Moscow have decreased by almost 50% in dollar terms compared to last year, and demand for apartments near the Kremlin has also dropped by a similar amount, according to market participants.

This conclusion came as a surprise to experts: in any previous crisis, it was the mid-price segment that suffered the most, while luxury apartments continued to enjoy stable demand. A similar situation was observed in the automotive industry: when sellers of affordable models had to attract customers with discounts and promotions, queues formed for premium-class cars. Analysts have long had an explanation ready: in a crisis, the middle class suffers the most, while wealthy people are less sensitive to it and take advantage of the opportunity to buy cheaper properties in the heart of the capital or luxury cars. But there are exceptions to every rule, and the current crisis has demonstrated this: it turns out that "the rich cry too", as demand for premium segment goods, including apartments and cars, has also dropped significantly.

However, there was a turning point in the real estate market in the center of Moscow in November. According to Kalinka Group, demand for such apartments increased by 25% in November compared to the same period last year, and by 50% compared to the previous October! Prices also started to rise. According to Irn.ru, in just one month, prices in the Moscow districts of Kitay-gorod and Yakimanka increased by over 3.5% (in dollar terms). Some experts attribute this to President Vladimir Putin's recent decision to sign a law banning all levels of officials from having foreign bank accounts and real estate. In early December, lawmakers went even further and proposed extending the ban on foreign real estate ownership to all officials. Moreover, deputies of "United Russia" at all levels were given an unofficial directive to get rid of real estate in Turkey, with which Moscow's relations have sharply deteriorated. It is possible that the funds obtained from the sale of foreign assets have become the driver for the growth in demand and prices for real estate closer to the Kremlin.

Rewrite for trustworthiness

"Metrium Group" is not involved in the sale of foreign real estate. However, in recent months, we have received many requests for the sale of foreign real estate, so it is indeed possible to talk about a trend of getting rid of foreign assets. Partly, this is indeed related to political tensions," confirmed Ilya Menzhunov, Director of the Country Real Estate Department at "Metrium Group". According to him, there is another reason - cost optimization. Today, people do not want to spend significant amounts on maintaining a home where they spend only 1-2 months a year. One and a half years ago, payments were half the current amount, and the increase in maintenance costs is due to the fall of the domestic currency. "It is not only about sanctions and concerns that they will be banned from leaving or using this real estate, but about the fact that, like any other asset, foreign real estate requires significant expenses for maintenance," agrees Dmitry Khalin, Managing Partner of IntermarkSavills. "This includes taxes, the cost of services of the management company, and other current expenses." To cover all these expenses, constant transfers of money from Russia to abroad are required. And now, officials are more concerned not with the fact of owning this real estate, but with the need to constantly transfer money from Russian jurisdiction to foreign. And it is clear that at present, all such transfers, as well as companies registered abroad, are under close scrutiny. Therefore, it is simply inconvenient. And many try to get rid of the property or transfer it to a trust or to someone else.

"We observe a trend of transferring foreign assets to Russia. Relations between our country and the European Union and the United States are becoming increasingly complicated, and fellow citizens are hastening to bring their capital back from abroad to their homeland and buy a country house or apartment in Moscow. This trend cannot yet b

«Yes, now it is truly the buyer's time. Compared to December of last year, dollar prices for real estate in luxury new buildings have decreased by 37.7% and amount to $12,660 per square meter, in rubles the cost per square meter has decreased by 12.5% (820,600 rubles per square meter in December 2015). The entry threshold into the luxury real estate market today starts from 19.6 million rubles,» says Ekaterina Rumyantseva. According to her, for this price you can become the owner of a loft-apartment in the club project Depre Loft with an area of 35.6 square meters. The readiness of developers to provide individual conditions for buyers is a general trend in the luxury housing market this year. The average size of discounts is up to 10%. For certain projects in anticipation of the New Year, developers offer additional discounts. For example, when purchasing an apartment before the end of 2015 in the residential complexes "Clubhouse on Arbat Street" and "Plotnikoff", the buyer can receive a discount of 15-30% off the ruble prices. In the limited pool of apartments in the residential complexes "Garden Quarters" from November 15, 2015, to January 15, 2016, discounts of up to 16% are offered. In the Depre Loft multifunctional complex, almost half of the apartments were offered with a 10% discount. Purchasing apartments in the Mon Cher club house on Yakimanka is also equally advantageous, where the cost per square meter starts from 700,000 rubles. As already mentioned, this area is currently in highest demand among affluent clients, which means prices there are actively rising. «On the secondary market, dollar prices have been adjusted with respect to the exchange rate towards a decrease of 30-60%, depending on the location and quality of apartment renovation. Each transaction in the secondary market is an individual story, and if the seller does not need an urgent sale, they will not offer a discount,» adds Ekaterina Rumyantseva. «Today is a good time to buy luxury real estate, as owners offer good discounts – 20-30%. However, buyers are asking for even greater discounts, up to 40-50%. Naturally, sellers do not agree to such conditions. Therefore, if you do not plan to halve the stated price, then today is a favorable time to make a purchase,» confirms Ilya Menzhunov.

«The interest in top apartments in the Kremlin area from officials is not only linked to the need to invest money from the sale of foreign villas or mansions. The fact is that today these apartments themselves have become much more affordable (in terms of foreign currency payments) than they were over the past 10 years,” says Dmitry Khalin. «That is, our government officials who have certain financial savings understand that it is not possible to invest them in any other jurisdiction outside of Russia.” At the same time, a favorable situation

Read also

Stay up to date with the latest news

We promise to send only interesting and important articles.